Oil Ain’t Tomatoes – Part II

Posted in Oil Prices, Other Current Affairs, United States on July 28th, 2008 by Jacob28 July, 2008

In Part I I made some comparison between crude oil and tomatoes for the purpose of illustration. Crude oil, (and indeed petroleum products) and tomatoes are commodities, commodity is an undistinguished article of trade. This to say that you cannot distinguish, nor do you care to, assign value any characteristics which is not generic to such article. For example you would assign monetary value to octan rating of your petrol (gas) but none to the refinery that produced it or the source of the crude that was used as stockfeed.

The same goes for tomatoes. You would assign value to it’s species, size, and degree of ripening but would not care less where it was grown or who grew it. The “brandlesness” of commodities means that the competition between the sellers (or buyers) is on price only, the nightmare of every marketeer.

In fact millions or even billions are spent on branding commodities by heavy advertising, the idea is to get you to believe that one brand of baked beans is better then the other thus be willing to pay more those beans that are labelled “Heinz” then for the generic brand of your supermarket, although both may well were canned by the same cannery and the only different between the two is the label on the can.

However, there are some fundamental differences between oil and tomatoes and that that is that tomatoes are product that it’s availability is established after it has been produced whilst oil has its value whilst it is still in ground. Further, tomatoes are perishable, meaning that they have a relatively short life after production, whilst oil does not change its qualities with time.

Suppose you bought tomatoes futures options from me for next season, I now MUST produced those tomatoes for you irrespective of market price to be ready to deliver to you should you exercise your option. But, and it is a big “but” if you will choose not to take delivery of my tomatoes because you will be able to get them cheaper elsewhere, I would have to cold store them whilst looking for buyers whilst my tomatoes still have value, otherwise I would lose all that I had spent on producing them.

On the other hand if the crude oil futures option is not exercised, it had costed nothing, such oil simply stays in the ground, the oil producer does not even has to pay for storage, his “next season” oil is waiting. He can offer it spot or just ‘sit on it” for a while.

A short Lesson In Economics

Economics is the art of explaining why the last (economic) prediction did not materialise.

(not me)

Firstly, although some would like to pretend otherwise, economics is not a science. Science is about observation and proving or disproving hypotheses, we don’t do that in economics. In economics we observe, theorise, hypothesise and hop for the best. Economist cannot carry out experiments that prove or disprove anything.

Secondly, over the years economics was tainted with ideology between the two extremes of laissez faire a la (Milton Friedman) to John Keynes’s government knows best. Both gentlemen fail to convince me with their arguments, mainly because their explanation of (economic) events are mere OPINIONS, not facts.

Thirdly, most economic theories are based on two assumptions, one that all (or most) players act rationally and two that all players has the same information (not necessarily all of it).

Just think how rational is Hugo Chavez’s oil policy or the Arabs place oil embargo on the west in 1974. Further how much information professional traders have about electronic trading outside the USA.

We know, as a fact, that there is no shortage of oil, that the storage tanks of stockfeed (crude oil) and products are in good shape, all pointing to a supposed reduction of prices, yet crude oil reach its highest price ever a week or so ago (I’ll get to the current price fall later).

The feeble excuses from the so-called experts tells me that they are either fools or con artists, I doubt that the are fools. Sure the demand from China, India and other developing counties would certainly increase prices, but such increase is gradual. Chinese and Indian demand does not explain this:

What about the hurricanes in the Gulf (of Mexico) excuse? How long a hurricane lasts? Three days, four, a weeks? How can that affect the GLOBAL crude oil prices when the storage tanks around the world are full. And once the Hurricane has gone and prices did not come back, they, the so-called experts need to find other “reasons” to explain the high prices,

How about Mahmoud Ahmadinejad threatening Israel and vice versa, Give me a break! Iran is on its last leg to stop being an oil exporter, they are already importing oil products because they lack refining capacity to satisfy their own domestic demand – petrol (gas) queues are commonplace in Iran of today. Iran is expected to continue to export oil until their Natural Gas (LNG) reserves can replace their oil export earnings which is essential for their development.

The crude market has already allowed for no Iranian oil export, when that finally happens the effect on the market will be negligible.

BTW Indonesia already stopped exporting oil for the same reason, domestic demand, and subsequently is no longer a member of OPEC, it did not make the news because the market had allowed for it.

Do you get the same feeling I have that Something is missing from the tale of crude oil prices.

Crude Pricing

As we saw in Part I crude oil prices are set by reference to prices “Benchmark” or “markers”, those are West Texas Intermediate (WTI), New York Mercantile Exchange (NYMEX), Brent, (Europe), Tapis (far East) and of course OPEC Basket. These benchmarks are similar to the more familiar stock exchanges indices such as Dow Jones, FTSE (London), DAX (Germany), ASX (Australia), TSE (Tokyo) etc. Each collects in formation on stock trading in real time and express it as an index.

A crude benchmark has two facets; characteristics (quality) and location where the crude is pumped (or gravity fed) into transport. The is expressed in US Dollar per barrel. Any variation in quality or delivery position is usually express as premium or discount off the benchmark, as the case may be.

For example, if the current freight cost from the Persian Gulf to US East coast is say $1.50 per barrel, the price for barrel of oil on the East Coast will be $1.50 higher then the price of similar oil in the Persian Gulf (all other things remain equal), simple logic.

Similarly if the cost of storage is $1.00 per barrel per month (I have no idea what the real costs are) and next month’s future price is say $130 per barrel, I’ll be happy to sell you oil I am holding for $129 today because it will give the same net that as if I sell it in a month time and pay out storage cost.

Crude oil in the ground has no storage costs thus a change in the oil futures immediately translate into the spot price. Do you see what I see?

With regulations and people standing behind your back watching what you are doing, it is quite difficult, if not impossible, to fiddle the spot market, particularly if you are dealing with wet barrels (the physical oil) but with the advent of electronic trading, particularly on non-American markets, the possibilities of manipulating the market are endless, if you have the motive and the dough of course.

Knock Knock Who Is There?

Knowing the motives for trading in the future market tells us who are there. There are basically three reasons for trading any future market:

- Users of the product that is traded; those who take physical delivery.

- Hedging and other long term funds; those who use the (future) market to hedge their investments by reducing risk, i.e. shield them from market fluctuations, particularly downturns

- Speculators; those who are in the market to take advantage of short term changes in prices.

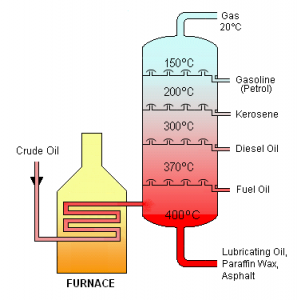

The only users of crude oil are the refineries; to anyone else crude oil is a useless product. Refiners take positions on oil futures to protect the continued supply of future stockfeed (crude oil) at a known maximum price, remember, they can always not exercise their option to take delivery and buy in the spot market if the spot price is substantially (at least 10%) lower then their option price.

The refiners also participate in the futures markets by offering future contracts for their products, mainly gasoline and distillates (diesel and heating oils), thus it is only prudent for them to protect both their supply and the price the stockfeed needed to meet their obligations.

Sometime ago the aviation industry, namely the airlines “discovered” the futures market and have been high purchaser of jet fuel futures since. The do it to mitigate their fuel costs. The effectiveness of such strategy depends on many aspects but nevertheless the practices is wide spread among the airlines.

However, unlike Europe and Asia, the US does not have a futures market for jet fuel, thus the US airlines take positions on crude oil futures as a hedge against jet fuel price rises. But it goes further then a simple hedge, to hedge the costs of one barrel (42 gallons) jet fuel the airlines need to buy 3 barrels worth of crude oil futures. Here you have it, a large demand for future “paper barrels” that is bought in order to be sold, those are the very same barrels that the refineries are bidding on to produce the jet fuel the airline are hedging – the dog is chasing its own tail!

Next are the hedge funds who use crude oil futures as part of their portfolio. One would expect the hedge to have commodity futures in their portfolio but the question is whether crude oil is more then just a part of the mix. To answer that one must know who are in the funds and what they actually hold.

Who Are The Real Speculators?

According to the Commodities Futures Trading Commission (CFTC) speculator is an entity that:

does not produce or use the commodity, but risks his or her own capital trading futures in that commodity in hopes of making a profit on price changes.

Such definition puts the hedge funds amongst the speculators, I disagree; speculation, in my view, must have short term aspect to it and whilst hedge funds may well speculate on occasions, by their very nature they are long term funds.

My definition of speculation is:

Speculation is trading with the object of taking advantage of short terms price differentials.

Hedge fund that hold a financial assets for 12 months is not speculating despite the fact that, by their nature, hedge funds “does not produce or use” anything. By the same token a refinery that produce products without having a ready market for it is speculating.

The reason I distinguish is that I see the speculators as harmless and their affect on prices minimal, this is not the case of the big funds, hedge and others such pension and super funds.

On 1 June 2007, the Dubai Mercantile Exchange (DME) , a joint venture between NYMEX and Mohammed bin Rashid Al Maktoum the ruler of Dubai (through a holding company) with the Sheikh of Oman in there too. Needless to say that DME is “regulated” by the government of Dubai, who???? … yes … Sheikh Mohammed himself!

Perhaps you care to take a look again in the crude oil prices and when prices last took off.

Since its inception, just over a year ago, DME traded about 390,000 future contracts (or 390 million barrels) of crude oil, this represents about 1 million barrels per day (mbpd) compares with United Arab Emirates (UAE) total production of about 2.5 mbpd.

How much UAE’s own oil is traded on the DME and what is the US portion is anyone’s guess but may I suggest to you that most of the oil comes from the UAE and Oman and most of it is in fact traded by American kind of hard to see the NYMEX get involved in exclusive trading between Arab Japanese.

Nice work Charlie, a semi American exchange operates under the radar of the American (or other consuming country for that matter) regulator, where the largest trader is the regulator. The optimacy of the golden rule, he who has the gold makes the rule.

And there is the so-called “Enron Loophole” that exempted electronic trading from much of the regulation, whilst the loophole itself has been closed by the recent amendment to the Farm Bill, how much has skipped the eyes of the watch dog?

Here is a scenario, the total US annual consumption of crude oil is about 5.5 billion barrels, at “only” say, $125 per barrel makes the total value $690 billion, say $700 billion. The actual cash outlay to buy crude oil future is 10% of the value of the contract i.e. it takes a “mere” $70 billions to buy contracts that covers the US consumption for one year.

Question one: Who has the oil to offer such a quantity?

Question two: Who has $70 billion or so that can be used (or freed) to buy that quantity?

Question three: Do you still wish to explain oil prices by economic rules that are applicable to tomatoes?

© Copyrights Jacob Klamer 2008, all rights reserved.